Rahm calls for the largest property tax hike in modern Chicago history

Chicago Mayor Rahm Emanuel calls for property-tax hikes, garbage-collection fees and ridesharing surcharges as a stop-gap measure to plug the city’s $750 million budget hole.

Chicago Mayor Rahm Emanuel is reportedly set to call for the largest-ever collection of fees and taxes to plug the city’s $750 million budget hole.

Official city sources have told the Chicago Sun-Times and the Chicago Tribune that the fiscal year 2016 budget will include the following major tax hikes and fee increases:

- $450 million in property-tax increases for the city’s bankrupt police and fire pension systems

- $50 million in property-tax increases for school construction

- $100 million garbage-collection fee

The property taxes will amount to an additional $500 in taxes each year on a home worth $250,000. The garbage fees will cost every city household an additional $11 to 12 a month..

Additional fees will provide another $150 million for the budget:

- A tax on e-cigarettes and other smokeless tobacco products – equivalent to the approximately $7 tax now levied on a pack of cigarettes

- $1 per ride surcharge on Uber and other ride-hailing services

- A penny-an-ounce “fat tax” on sugary soft drinks

Unfortunately for Chicago taxpayers, these increases in taxes and fees don’t even include what’s needed to fix the enormous budget deficit facing Chicago Public Schools, or CPS, and its nearly $10 billion pension shortfall.

On top of these fees and property-tax hikes, Emanuel also wants an additional property-tax levy of $170 million to pay for the school district’s yearly pension costs, but only if he can work out a deal with the state for additional CPS funding.

The tax hikes and fees Emanuel is proposing won’t solve Chicago’s or CPS’ real problems – they’ll just temporarily fill gaps in their budgets.

There are two reasons why these tax hikes will ultimately fail.

First, these tax hikes, massive as they are, are not nearly enough to cover the full amount of Chicago’s debts. Without real pension and spending reforms, still more property-tax hikes will be needed.

And second, these tax hikes will only serve to lower Chicago’s tax base, as thousands of residents start to flee the city. This will accelerate the out-migration of residents that has been going on for decades and has been a boon for Chicago’s collar counties and Lake County, Indiana.

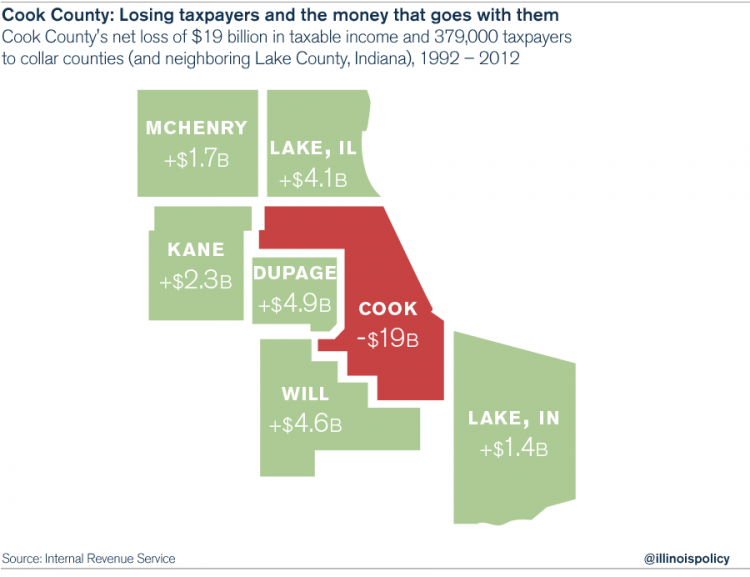

According to Internal Revenue Service data, Cook County lost a net of 379,000 taxpayers to its six neighboring counties from 1992 through 2012. When dependents are included, Cook County lost nearly a million people on net. Those taxpayers took a net of more than $19 billion in taxable income with them.

And in 2011 alone – the first year of Illinois’ historic 67 percent income-tax hike – Cook County lost 9,600 taxpayers and 18,000 dependents on net, which means the county lost nearly 28,000 more people than it gained. These taxpayers took more than $900 million in adjusted gross income with them that year.

Chicagoans will continue to leave because they know these tax hikes and fees won’t be used to pay for improved services such as better roads, classroom needs or increased public safety. Instead, these fees and taxes will only go to pay for old debts and services already rendered, particularly pensions.

When Emanuel was elected, everyone expected him to take on the big reforms – to not let Chicago’s fiscal crisis “go to waste.” He would be the one to finally take on the unions and enact the pension and spending reforms former Mayor Richard Daley had avoided.

After more than four years in office, Emanuel has abandoned his reform-minded persona. Now he’s taking the easy way out by sending the bill to taxpayers.