Parks and wrecked: City’s reform of Chicago Park District’s pension fund challenged

A challenge from the SEIU is looking to set back the city’s attempt to stave off the Chicago Park District's pension-fund insolvency.

On July 24, the Circuit Court of Cook County struck down a municipal-workers pension-reform law. Now it appears that the city’s reforms of the Chicago Park District’s pension fund may also be challenged in court.

The Park District’s largest employees union, Service Employees International Union Local 73, says it intends to sue the city over the reform, arguing that it violates Illinois’ constitutional protection of Park District employee pensions by increasing employee-contribution requirements and rolling back cost-of-living adjustments.

Whatever the outcome of the union’s lawsuit, the Park District pension fund’s finances are likely to worsen.

The Park District’s pension fund has a $500-million shortfall and less than half the money it needs to pay out future benefits.

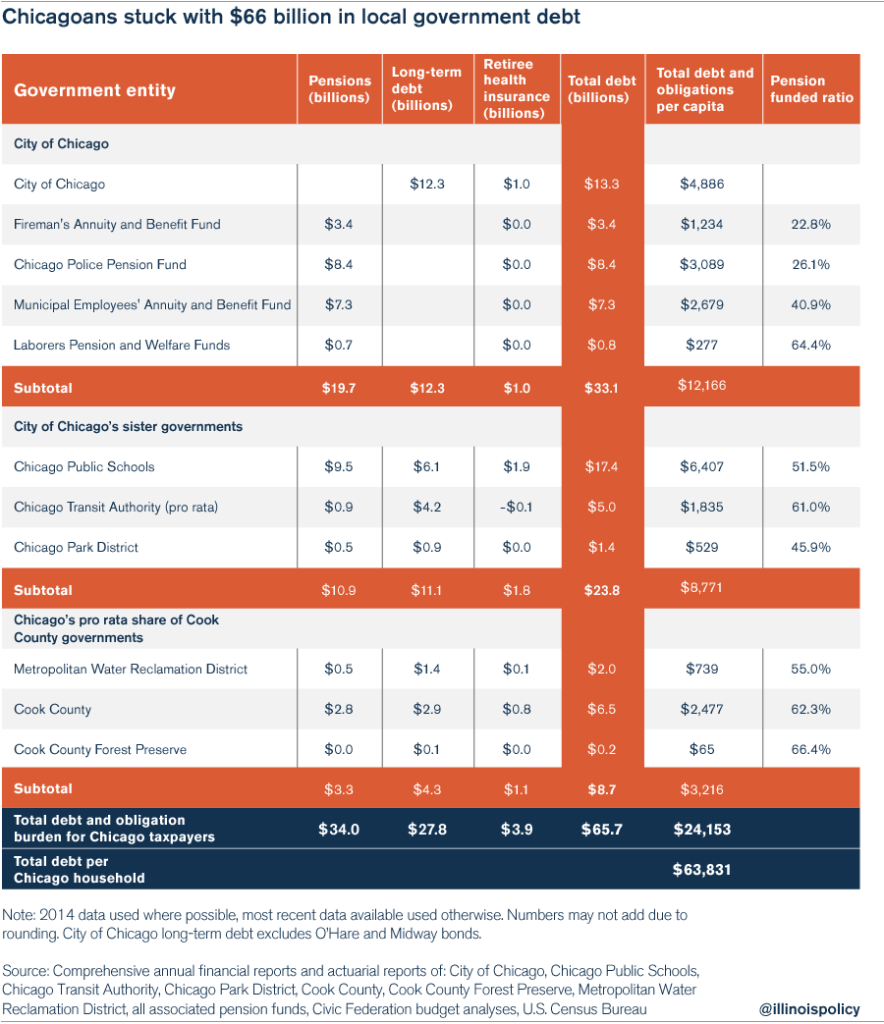

What’s worse, the Park District’s shortfall is only a tiny part of the city’s massive pension crisis.

Chicago households are stuck with more than $35 billion in pension debt for the city’s many government workers. And when all other long-term and health-insurance debts are added in, each Chicago household is on the hook for nearly $64,000 in future tax bills – much of it for services already rendered.

If a court strikes down the reforms to the Chicago Park District pension fund, Chicago will be back at square one trying to reform its government-worker pensions.

But there is one major reform the city could undertake right now to set itself on the path toward financial stability: It could create self-managed retirement plans, or SMPs, such as 401(k)-style plans, for new city workers going forward.

Instituting SMPs would help restore confidence in the city by showing credit-rating agencies and other financial institutions that Chicago is serious about financial reform. It would demonstrate that the city will no longer pass half-measures that don’t fundamentally change the way retirements work.

And the city doesn’t have to look far for a model SMP plan: One already exists right here in Illinois. Today, almost 20,000 active and inactive members of the State Universities Retirement System participate in a 401(k)-style plan. These state university workers control their own retirement accounts and aren’t stuck in Illinois’ increasingly insolvent pension system.

Once SMP plans for new workers have been established, Chicago could then work on transferring current workers to such plans as well. That would mean first advocating for an amendment to change the pension-protection clause in the Illinois Constitution, which the Illinois Supreme Court has interpreted as prohibiting the alteration of any employee benefits – even those not yet earned.

That’s the path to real reform that Chicago needs to take.