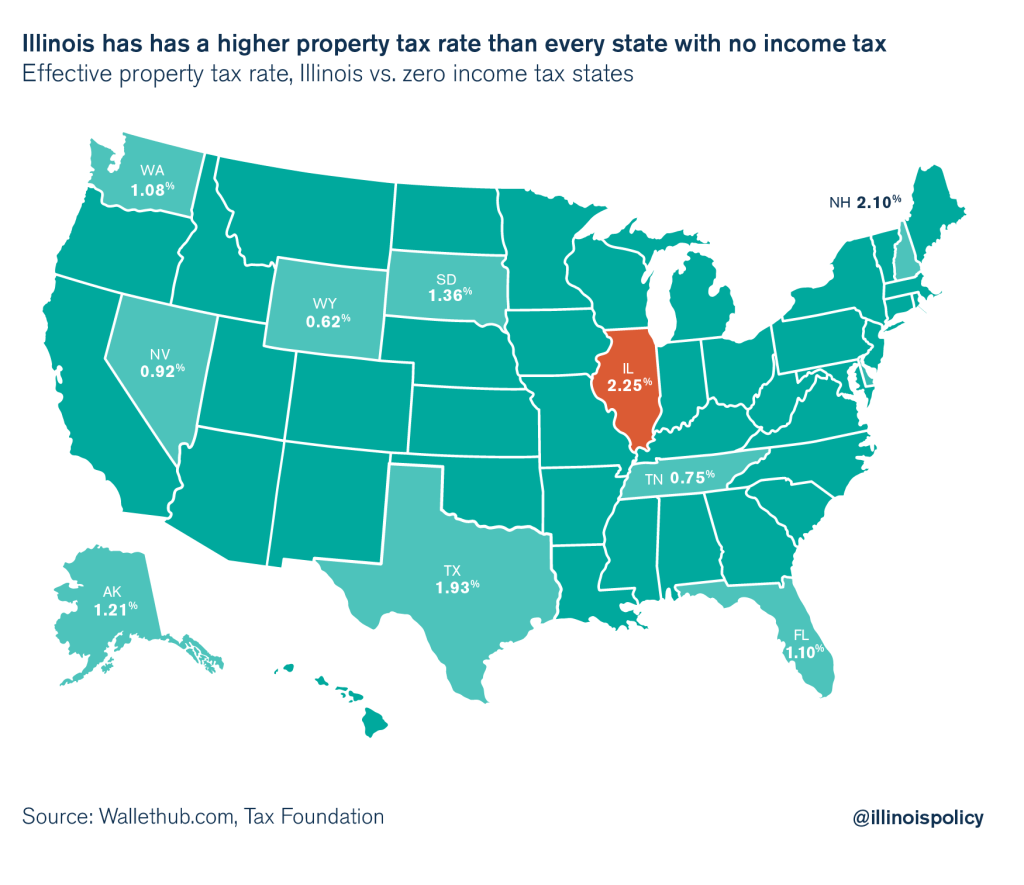

Illinois has higher property taxes than every state with no income tax

Despite taxing both sales and income, Illinois has higher property taxes than every single state that does not charge an income tax.

Illinois’ extraordinarily high property taxes are a symptom of a serious problem: too much spending that local governments cannot control.

But some claim Illinois’ high property taxes (and sales taxes) are the result of the state having a lower-than-average income tax. But that’s not true.

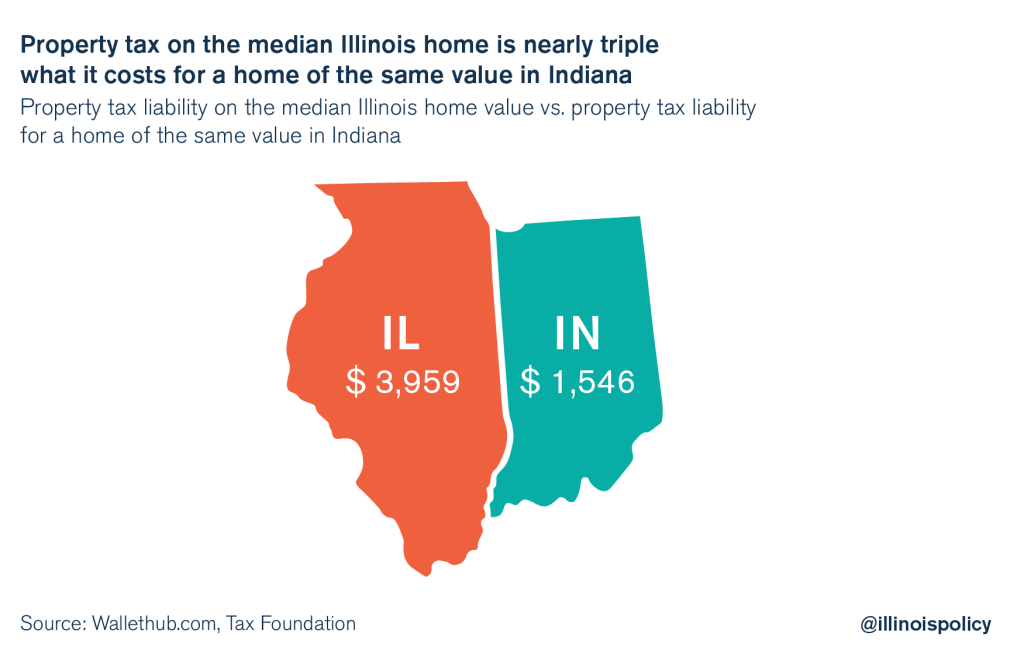

Illinois’ property taxes are higher than the property taxes in every state that has no income tax at all. Clearly, these states and many others are able to keep their property taxes low even without income tax revenues. Illinois property taxes are nearly triple those in neighboring Indiana, which also has a low, flat income tax rate.

The breakdown

Nine states do not have an income tax. They are geographically, politically and economically diverse. One thing they do share in common is that they all have lower effective property tax rates than Illinois, according to a 2016 study by wallethub.com.

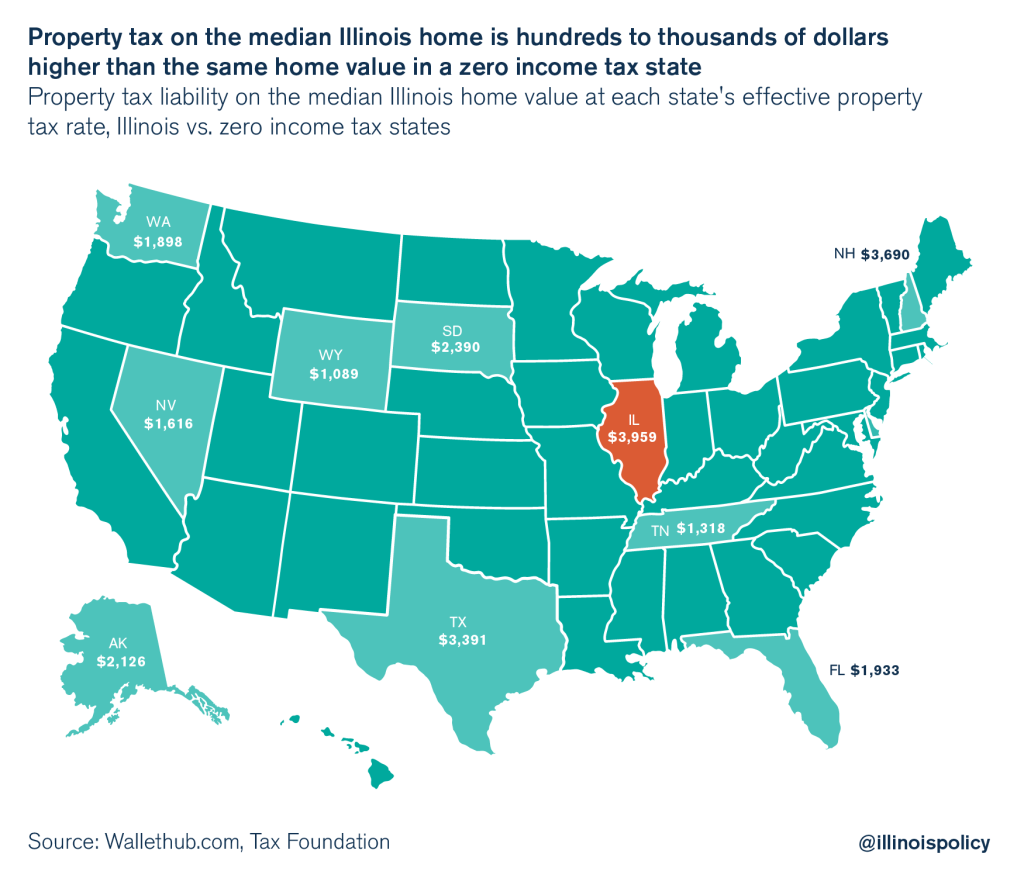

The median home value in Illinois is $175,700 according to the wallethub.com study. The annual property tax on the median home value is $3,959 per year at Illinois’ average effective property tax rate. The same home would have significantly lower property taxes in any of the states that have no income tax. A homeowner with the same home value would pay $570 less in property taxes in Texas, $2,000 less in property taxes in Florida and Washington, and $2,600 less in property taxes in Tennessee.

Illinois is consistently in the top three highest property taxes in the country, usually behind only New Jersey, which has a very high income tax rate. Illinois has higher property taxes than all states that have competitive income tax rates.

Indiana: A flat income tax neighbor with drastically lower property taxes

One comparison that is closer to home for Illinois is Indiana, where the statewide income tax rate is 3.23 percent, with some localities also having income taxes. Illinois’ current income tax rate is 3.75 percent, with legislators talking about raising it as high as 5.25 percent. Despite having similar income tax rates, Illinois’ property taxes are nearly triple Indiana’s property taxes on a home with the same value.

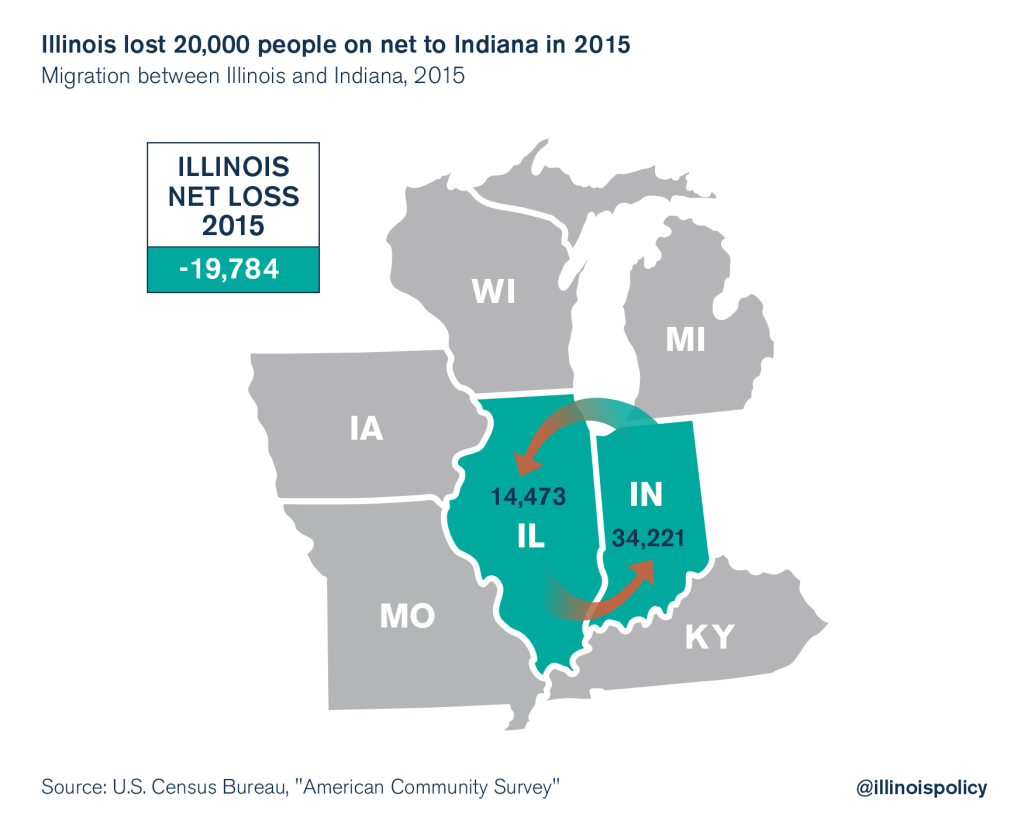

The difference in property taxes between Indiana and Illinois undoubtedly contributes to the flood of people moving across the border from Illinois to Indiana. In the most recent year of data, Illinois lost 20,000 people to Indiana, on net.

Illinoisans need property tax relief – and they can’t afford income tax hikes

The property tax is the largest of all taxes collected in Illinois, and is the most obvious symptom of Illinois’ governance and spending problems. Some of the spending is driven by the decisions of local political leaders. Much of it is also driven by state mandates for collective bargaining with government unions, minimum manning rules, prevailing wage laws, workers’ compensation requirements, and pensions and education mandates, to name a few.

Illinois needs to solve the problem of skyrocketing property taxes, because it’s threatening home ownership and home equity values. Raising the income tax is not a solution, but allowing Illinoisans to consolidate local governments and relieving local governments of heavy state mandates is the only solution that will work.