Kentucky governor pushes 401(k)s to help resolve Bluegrass pension crisis

Despite the smaller relative size of its burden, Kentucky is considering making far more comprehensive changes to its public sector retirement systems than Illinois ever has.

Kentucky’s state pension crisis is bad – one of the worst in the nation. But it isn’t as dire as that of Illinois, and the governor of the Bluegrass State wants to keep it that way.

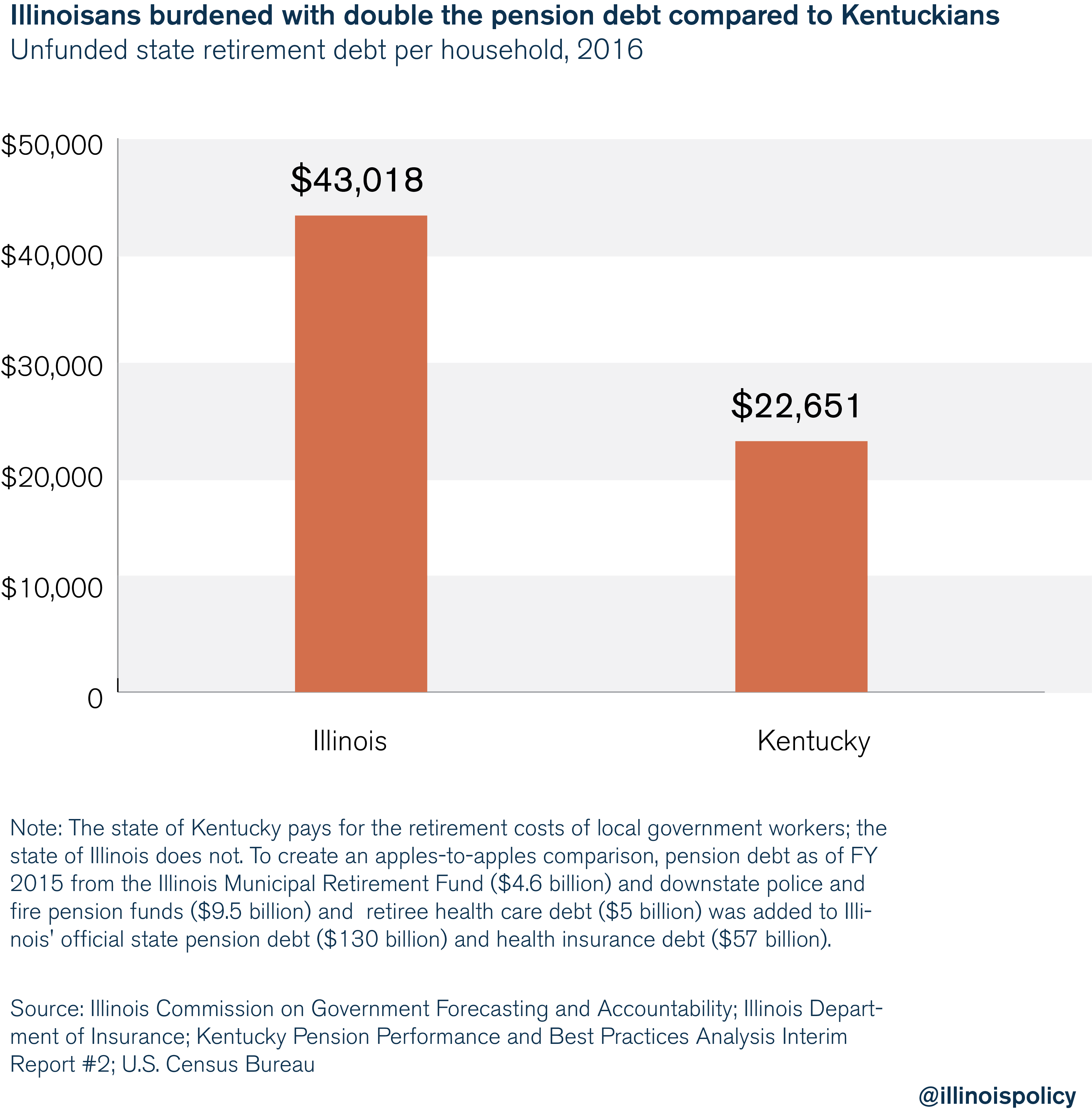

Kentucky Gov. Matt Bevin is promoting 401(k)s as the main solution to the state’s crisis going forward, even though Kentucky’s retirement debt burden per household is just half of what Illinoisans face.

Kenucky’s pension debt has grown significantly over the past decade. The state’s pension systems were almost fully funded in 2000, but have been declining ever since. Now, lawmakers are looking for solutions so retirement costs for government workers don’t get worse.

“The net result…[is] something more like a 401(k)-type, defined contribution type, with matching, with the ability to be portable. And that’s in line with what’s happening everywhere else in the real world, and frankly it’s what will have to happen,” Bevin said.

Each Kentucky household is on the hook for $22,600 in pension and retiree health insurance debt. That amount, by any measure, is already at crisis levels. Illinois’ pension crisis, by comparison, is about double that, with households burdened with over $43,000 in retirement debt.

Yet, despite the smaller relative size of its burden, Kentucky is considering making far more comprehensive changes to its public sector retirement systems than Illinois ever has.

Bevin recently released the final report of a consultant group hired to examine the state’s pension crisis. The group’s analysis highlighted the dire straits of Kentucky’s crisis and recommended several reforms – including the creation of 401(k)-plans for new workers.

In contrast, Illinois has a long history of failed pension reforms. The changes the state has pursued in the past have been minor, unfair, unconstitutional or have made the crisis even worse.

Kentucky and Illinois’ big crises

Illinois’ massive $130 billion in pension debt usually ranks it at or near the top of the list of state pension crises.

Kentucky also tends to rank near the top of the pension crisis list. The Bluegrass state has been dealing with a growing $33 billion state pension crisis of its own for more than a decade.

Both have less than half the amount they need to meet their future obligations. If either state’s collection of pension funds were in the private sector, they would have been declared bankrupt many times over by now.

But while both Kentucky and Illinois’ pensions are in terrible shape, Illinois’ crisis is worse in almost every way.

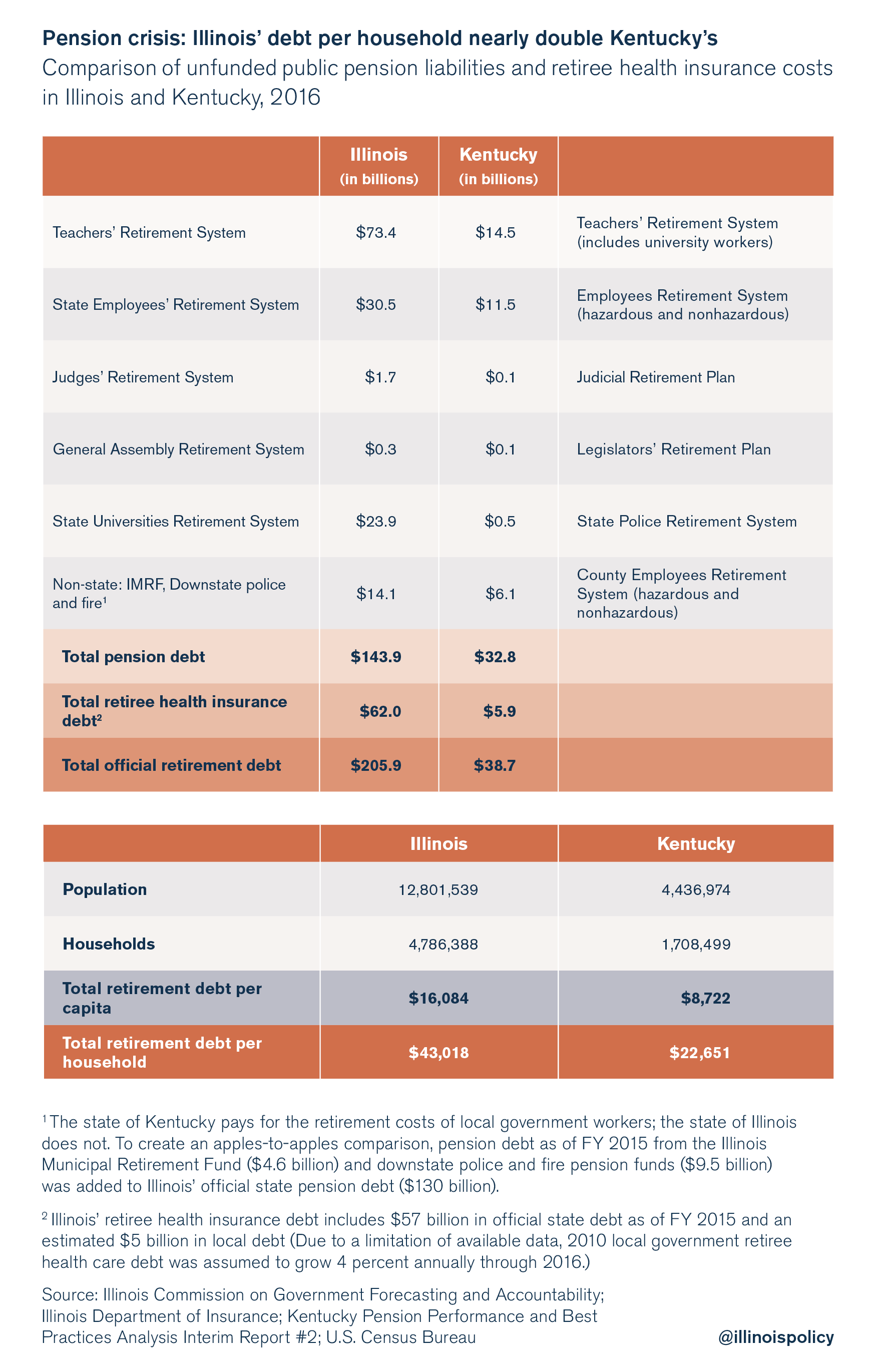

After adding local pension and retiree health insurance debts to Illinois’ total to allow for an apples-to-apples comparison with Kentucky (the state of Kentucky pays for the pension costs of local government employees while the state of Illinois does not), Illinois owes about $206 billion in unfunded retirement debts compared to Kentucky’s nearly $39 billion.

In per household terms, Illinois’ debt imposes nearly double the burden Kentucky’s does. Illinois households are on the hook for $43,000 in debt while Kentucky households are burdened with $22,600 each.

It should be noted that the above comparison understates the size of both states’ pension crises by using both states’ official actuarial numbers.

Illinois’ pension crisis is far worse under more realistic accounting methods. For example, Moody’s Investors Service calculates Illinois’ state pension debt is closer to $250 billion, far larger than the state’s official $130 billion. And Kentucky’s pension debt in 2014 was closer to $40 billion – far larger than the state’s official $30 billion debt.

And Joshua Rauh of the Hoover Institution found that under conservative assumptions, Illinois’ 2015 unfunded pension liability equaled more than $360 billion and Kentucky’s equaled nearly $68 billion.

Kentucky’s proposed pension reforms

In 2017, Gov. Bevin hired a consulting group to analyze Kentucky’s pension crisis. The group released a final report in August, which included its proposed solutions to the crisis.

One of the biggest reforms the consulting group recommended for Kentucky was the creation of 401(k)-style retirement plans going forward for new teachers, university employees, state workers, local government workers, judges and legislators. K-12 teachers would also start paying into Social Security along with their new 401(k) plan.

The group’s final report also recommended other major changes, including increasing the normal retirement age for new teachers and university workers to 65 from 60, ending new workers’ ability to grow pension benefits by accumulating and applying unused sick leave, rolling back some cost-of-living adjustments for active workers and ending cost-of-living adjustments for teachers, university workers, legislators and judges until their pension systems reach 90 percent funding.

Other than some changes to cost-of-living adjustments and early retirement rules, the report recommended leaving the benefits of local and state public safety workers virtually unchanged.

In all, the consultant group found that its proposed reforms could save Kentucky over $1 billion a year in state pension costs.

By providing a reasonable plan that includes 401(k)s for almost all new workers, the consultant group’s report will at least move Kentucky politicians’ discussions toward a solution that actually begins an end to the state’s pension crisis.

Illinois pension crisis needs comprehensive reforms, 401(k)s

Kentucky lawmakers are debating the consultant group’s proposed reforms, which if enacted, will go a long way toward ending its pension crisis.

Illinois lawmakers, on the other hand, have spent decades ignoring the reforms necessary to begin an end to the pension crisis in Illinois. They’ve spent time papering over the crisis with higher taxes and borrowing. They’ve passed “reforms” that turned out to be minor, unconstitutional, or unfair. And some “reforms,” like then-Gov. Jim Edgar’s pension ramp compromise, only made the crisis worse.

Even Illinois’ most recent changes do little to bring the state’s pension crisis to an end. The new hybrid package allows workers to continue to accrue pension benefits. Workers’ retirements will remain under politicians’ control. And taxpayers are still on the hook for the cost of pensions. That’s unsustainable, as Illinois’ pension crisis will never end as long as pension liabilities continue to grow.

What should infuriate Illinoisans the most is that there has been a solution to the crisis right under lawmakers’ noses for nearly two decades. And it’s based on the same 401(k)s that Bevin is proposing in Kentucky.

A successful, standalone 401(k)-style plan for state university workers has been operating in Illinois for nearly 20 years and has over 20,000 members. Illinois can begin an end to its current crisis if it simply expands that 401(k)-style plan to all state workers.

Illinois should take a page from Bevin’s playbook. Rather than wait for things to get worse, Illinois should move to 401(k)s. Only then can it really begin to focus on the key reforms – from changes to the constitution to municipal bankruptcy – that will reduce Illinois’ massive pension debt.