COVID-19 recession could double Illinois’ delinquent mortgage rate in 2020

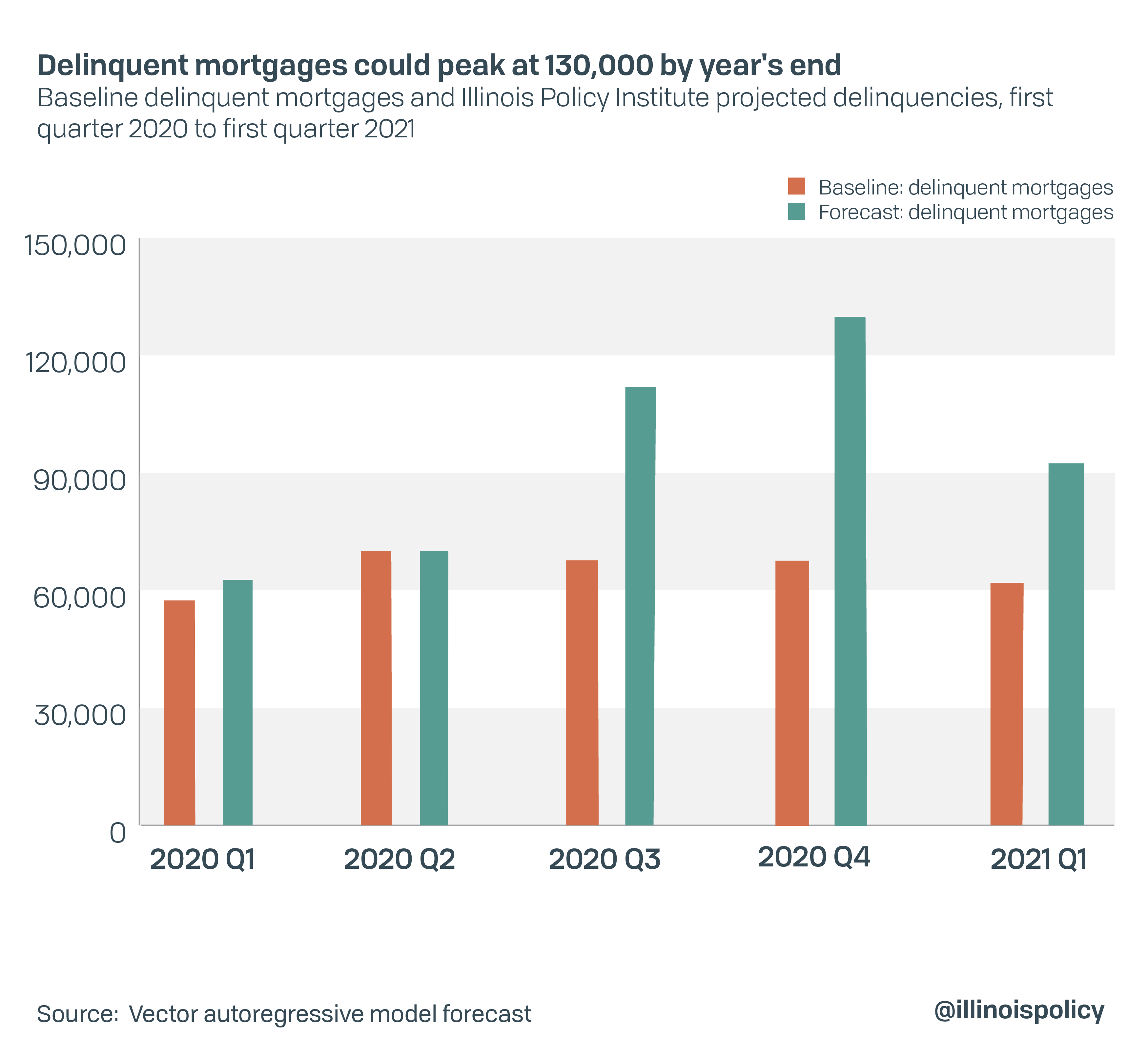

Up to 130,000 Illinois homeowners could fall behind on their mortgage payments if state lawmakers fail to provide relief.

Illinois’ housing market was one of the weakest in the nation prior to 2020.

But as the state economy has been brought to a sudden standstill and nearly 1.5 million Illinoisans find themselves out of a job, the number of families struggling to make their mortgage payments will surge.

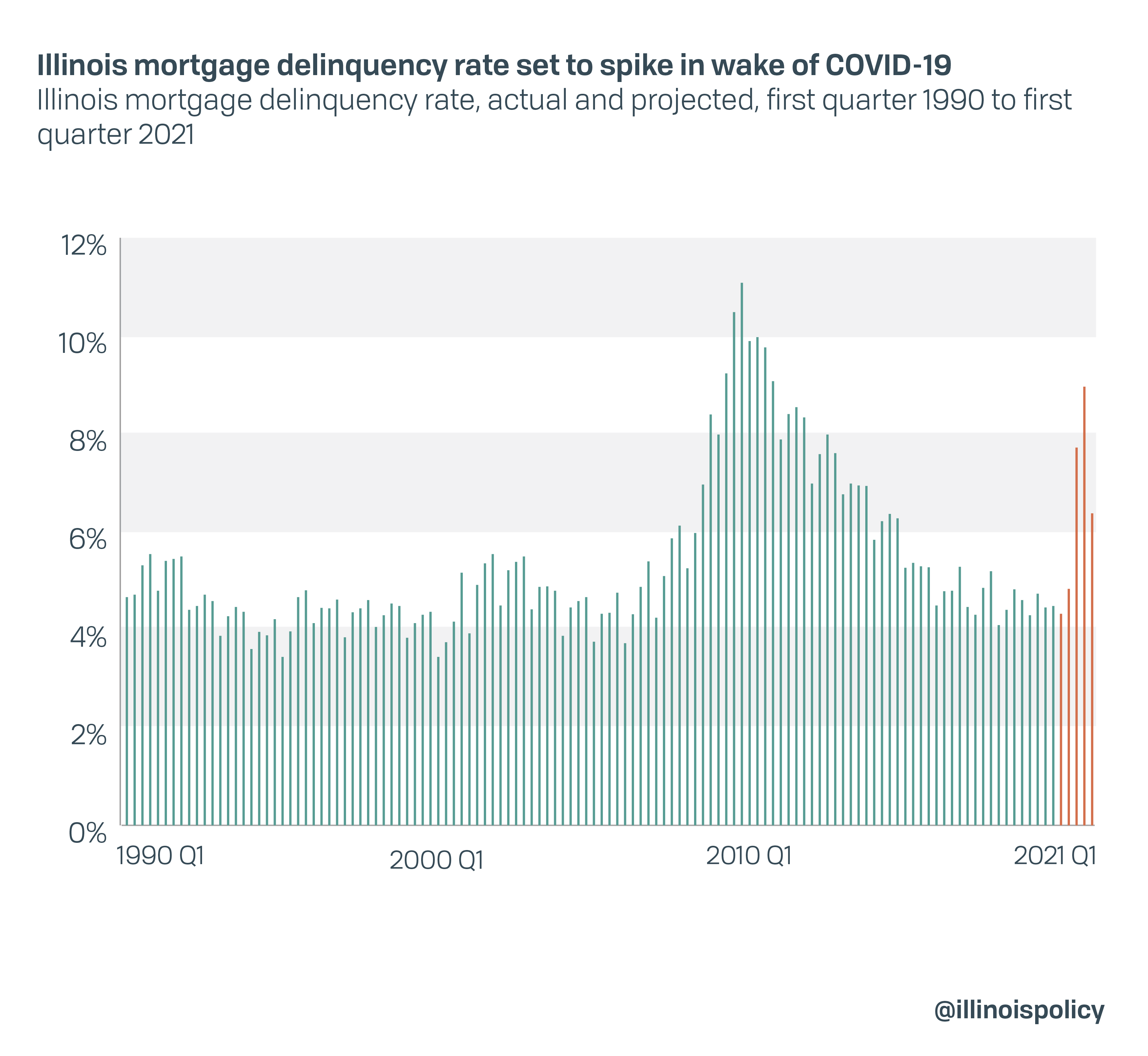

Economic fallout from the COVID-19 pandemic was made worse by one of the harshest lockdown orders in the nation. As a result, analysis by the Illinois Policy Institute shows Illinois could see mortgage delinquency double, behind only the Great Recession as the worst housing crisis in 30 years.

Absent unprecedented fiscal actions from federal and state governments, if the unemployment rate remains high and if demand does not continue to outpace supply in housing markets across the state, close to 130,000 households could fall behind on their mortgage payments. This means Illinois’ mortgage delinquency rate could double to nearly 9% – the highest since it peaked at 11% during the Great Recession.

Delinquency often leads to foreclosures, and foreclosures make economic downturns even worse.

Property tax relief could help struggling families stave off delinquency, but that requires action from state lawmakers. Illinoisans who have recently purchased their home likely pay annual property tax bills equal to nearly seven months of their mortgage costs. Providing extensions on paying property taxes, without penalties, would lower Illinois homeowners’ monthly costs to support consumer spending, which includes housing expenditures.

Illinois can avoid a housing downturn and mass mortgage defaults if:

- Sellers can afford to take their homes off the market instead of selling at steeply discounted prices. Property tax relief would reduce pressure on sellers, landlords and other homeowners.

- Illinois does everything possible to avoid business failures and permanent job loss. Research shows current labor market conditions predict an L-shaped recovery, meaning the economy isn’t likely to rebound immediately after the COVID-19 threat is averted. This is because job losses have been mostly concentrated among less-skilled workers who often need years to find stable jobs.

- The governor accelerates a sequential lift of lockdowns and a safe return to work. Most Illinois families cannot afford to be out of work for an extended period of time.

These steps and more – including Illinoisans rejecting a progressive income tax hike that would negatively affect 100,000 small businesses and labor demand – can help to avoid a catastrophe.

COVID-19 could spur potential housing crisis

According to a new report published by Attom Data Solutions, Illinois is the only state in the Midwest with housing markets among the 50 counties in the U.S. most vulnerable to the COVID-19 shock.

This is because Illinois already had a large number of underwater homes as well as the second-highest foreclosure rate in the country as of February 2020.

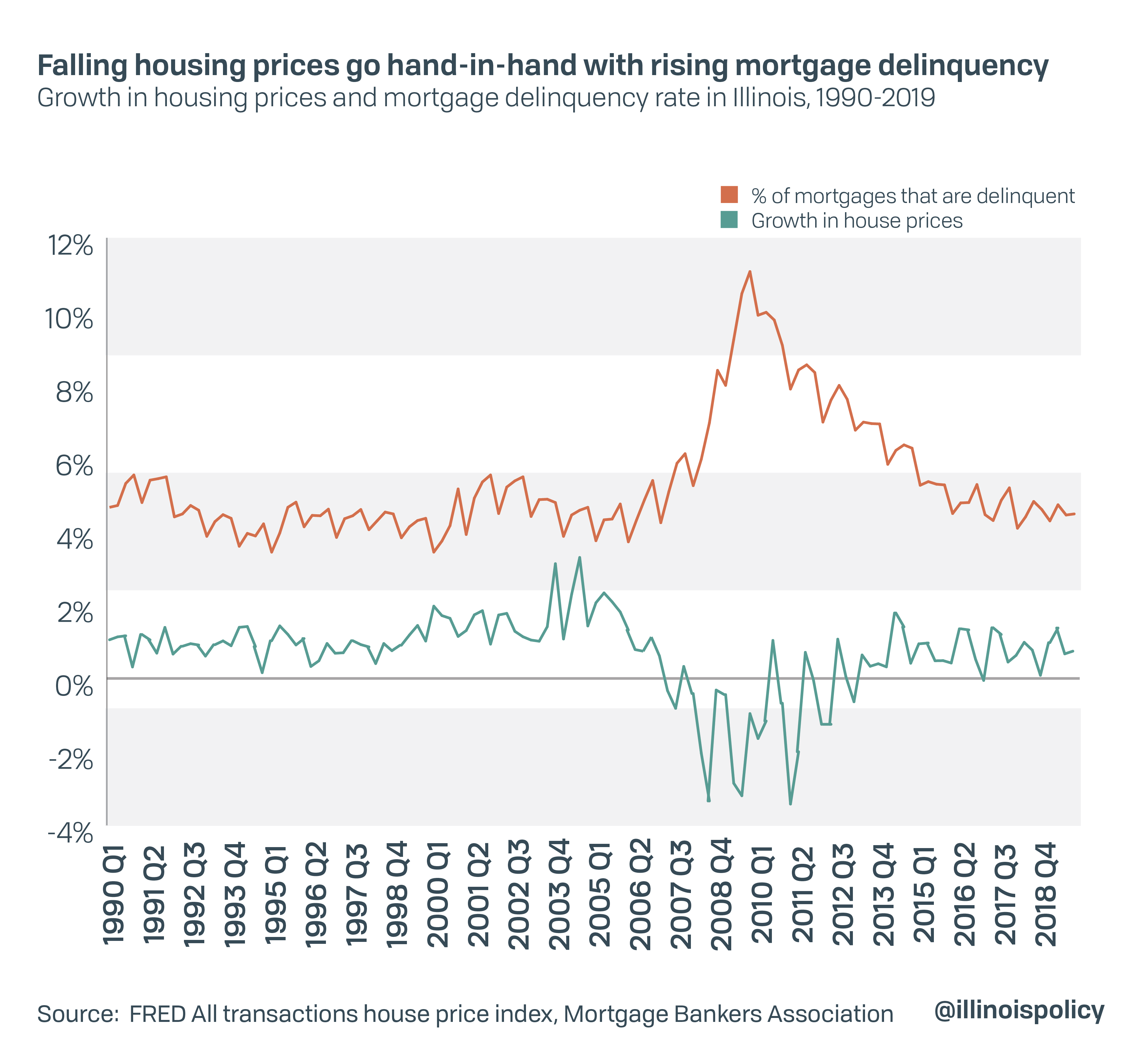

Illinois has had the third-lowest housing price appreciation in the United States on average since the end of the Great Recession. Weak housing appreciation is largely tied to declining demand as Illinois continues to experience population decline and more Illinoisans continue to favor renting over homeownership. Despite relatively low home prices and mortgage rates, homeownership is further discouraged by added costs such as property taxes, which are second-highest in the nation.

Growth in home equity is negatively associated with mortgage delinquency. If the value of your home goes up, then you are probably not going to experience delinquency. On the other hand, if you become unemployed and are already “upside down” on your loan – owing more on your mortgage than your home is currently worth – then you are more likely to enter delinquency.

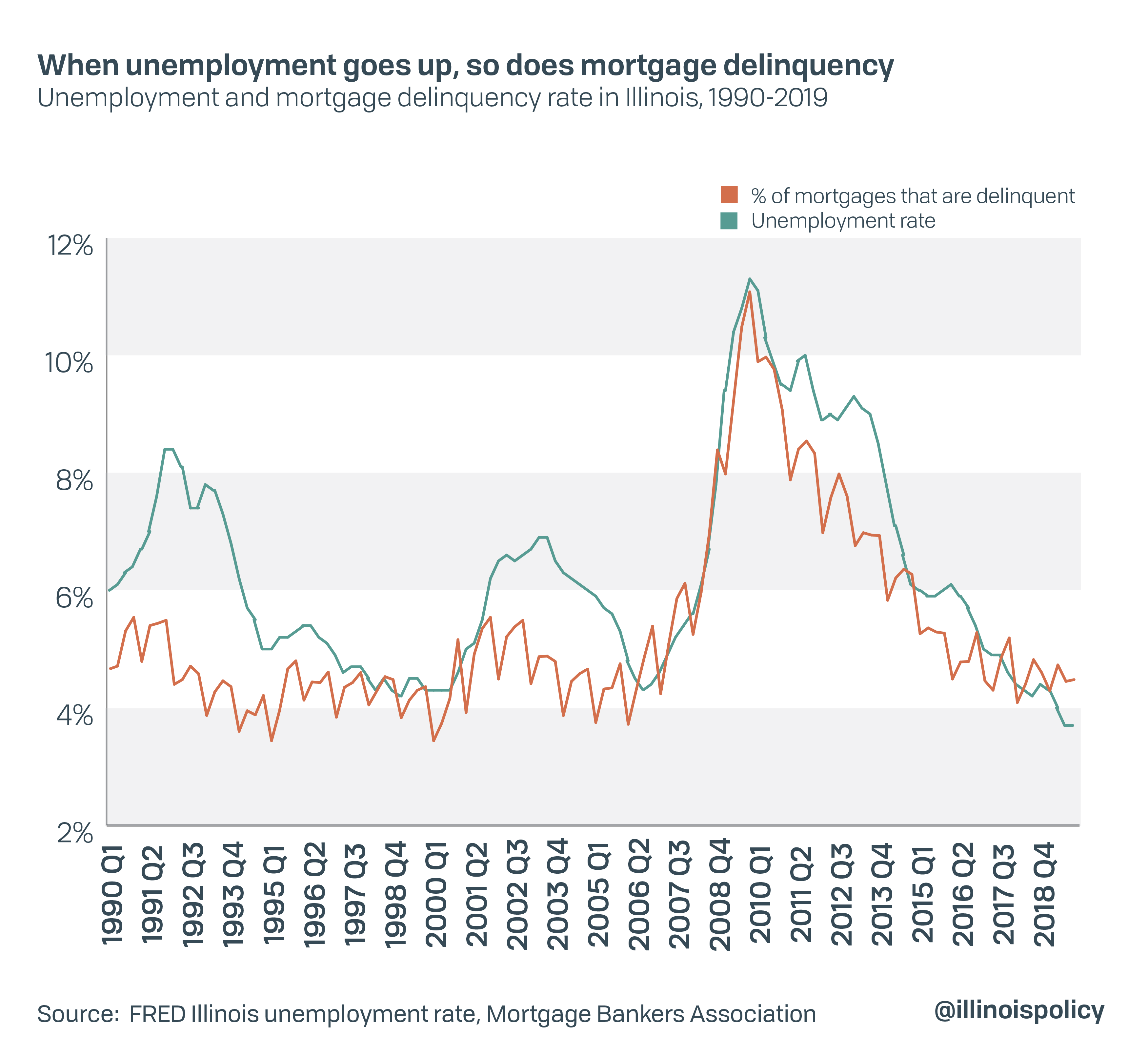

Now that 1.5 million Illinoisans have lost their jobs and income has fallen, many families may fall behind on their mortgage payments. This is because aggregate unemployment and aggregate delinquency tend to move in the same direction, as seen in the chart below. Meanwhile, aggregate income – which increases when more people are employed – and aggregate mortgage delinquency move in the opposite direction, meaning that delinquency rates can be expected to increase as incomes fall.

Using data from the Mortgage Bankers Association, the Illinois Policy Institute projection for mortgage delinquency uses the relationship between aggregate unemployment, housing price appreciation and aggregate mortgage delinquency (see appendix). The mortgage delinquency rate is the percentage of total mortgages for which payment is at least 30 days past due.

State government could act now by providing property tax relief

Other than the cost of their loans, property taxes are often Illinois homeowners’ largest annual housing expense. Recent homeowners likely make the equivalent of nearly seven additional mortgage payments each year because of property taxes.

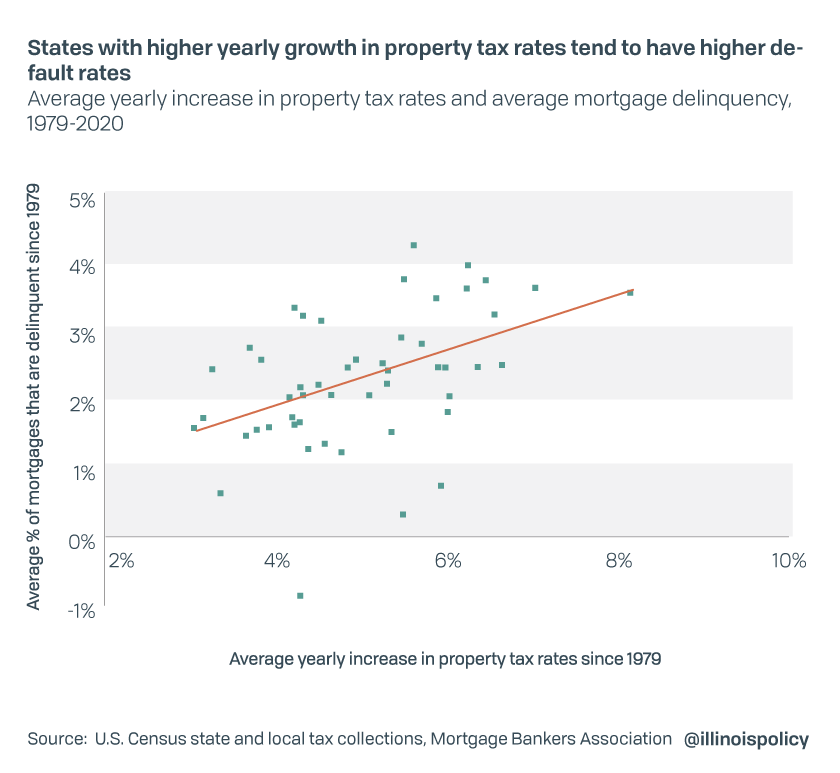

Increases in property tax rates reduce the “profit” from homeownership. When property tax payments are included in your mortgage agreement, a failed property tax payment means you are legally in default of your mortgage contract. These facts help explain the strong positive correlation between delinquency rates and property tax hikes.

Delaying property taxes payments, which are coming due in many Illinois communities in June, would provide relief for homeowners.

For sellers, it would also mean they can afford to hold onto their homes and wait until conditions improve instead of selling at large discounts. For some landlords, it means lowering immediate costs when most of their rental income has completely dried up.

Two Illinois lawmakers introduced bills in May to delay property tax payments. State Rep. Allen Skillicorn, R-East Dundee, filed House Bill 5768, which would push back penalties for late property taxes by 90 days when a public health emergency causes a disaster declaration in all 102 counties. State Rep. Joe Sosnowski, R-Rockford, filed House Bill 5772, which calls for a 90-day delay without penalties on 2019 property tax payments, which come due during the next few months. However, lawmakers ended this spring’s General Assembly session taking no action on these bills.

Multiple Illinois counties have voted on their own to delay payments to give residents relief. Kane, McHenry, DuPage, Sangamon and St. Clair counties have all provided extensions without penalties on property tax due dates.

Illinois law allows areas under a disaster declaration to waive fees and change due dates on property taxes. All 102 counties in Illinois are considered disaster areas by both the state and federal governments because of COVID-19.

Illinois homeowners again paid the nation’s second-highest property taxes, behind New Jersey, in the annual survey by WalletHub. The median Illinoisan with a mortgage pays $4,900 in property taxes on their $203,400 home, a property tax rate of 2.4% (the WalletHub survey includes those without a mortgage and shows Illinois’ property tax rate at 2.3%, both are second highest in the nation). This is the third consecutive year Illinois ranked No. 2 in the property tax survey.

With many Illinois homeowners uncertain about how they will be able to pay the bills, state lawmakers should return to Springfield for a special session to provide relief for these families or more counties should act to delay due dates.