Illinois’ pension costs, debt are growing far faster than state predicted

The pension crisis is worse than the state admits, and the state’s official projections cannot be trusted.

Illinois has the worst pension crisis in the nation, an ugly reality that is aggravated by the state’s sunny projections that things aren’t quite as bad today and won’t be as dire tomorrow as the numbers reveal.

During the past decade, the state consistently underestimated how fast pension costs and pension debt would grow in the future. That left taxpayers on the hook for $7.6 billion in unexpected costs. It also left social services on the chopping block and some policymakers with the impression that the pension problem could simply blow over.

Most of all, these flawed numbers have allowed Illinois’ political leaders to continue making promises they cannot keep while ignoring a pressing need for reform.

So far the only pension fix proposed by Gov. J.B. Pritzker is to add $200 million to the pension funds. He only plans to add that money if voters in November agree to let the state take another $3.7 billion out of the economy by approving his “fair tax” proposal.

There is a solution to Illinois’ public pension woes, but it starts with real numbers and a constitutional amendment.

The pension problem

Pension costs have overwhelmed the Illinois budget and swallowed up spending on core government services. Pension contributions now consume over 25% of the state’s general funds budget, up from less than 4% during the years 1990 through 1997.

State spending on public pensions has increased by more than 500% during the past 20 years, after adjusting for inflation. All other spending, including social spending for the disadvantaged, was down 32% since 2000.

In one example of this hollowing out of state government, the Chicago Tribune reported almost 20,000 adults with disabilities are awaiting admittance to programs funded by the state that would help them live on their own. The average waiting time is seven years.

In the current school year, 36% of the money the state allocates to education will be diverted to pension payments. This represents a 200% increase in spending on teacher pensions since 2000, compared with only a 20% increase on classroom spending during that period.

Despite massive funding increases and diminishing social services, the five state-run retirement systems – which serve teachers, state workers, public university employees, judges and members of the Illinois General Assembly – are only about 40% funded, a shortfall of $137 billion by the state’s accounting.

Unfortunately, the state’s pension hole is likely even deeper than the state admits.

Moody’s Investors Service calculated Illinois’ pension debt is not $137 billion but much higher at $241 billion. A key difference is Moody’s uses more conservative investment return assumptions similar to what are used in the private sector, around 4%, compared to the state-run plans that assume 6.5% to 7% returns.

Based on the Moody’s number, Illinois’ pension debt was equal to 500% of the state’s revenues in fiscal year 2018and almost 30% of the entire state economy, both the highest rates in the nation. If Illinois used more realistic assumptions, it would need to double the amount it spends on retirement benefits annually to 51% of the state’s revenues, according to Michael Cembalest, an expert at J.P. Morgan.

So how can independent analysts come up with numbers that are so vastly different from the state’s?

A history of rosy predictions

Using overly optimistic investment assumptions allows Illinois to both hide the true nature of its current pension debt and make projections about future contributions and the growth in pension debt that are not realistic.

This has been the case for at least the past 10 years, with projections failing to account for:

- A year such as 2009 when the five pension systems realized investments losses of 19.7% to 22.7%

- Five other years from 2008 to 2019 when investment returns were well below assumptions or the pension systems suffered losses

The five state pension systems predicted in 2006 that the state would need to make $3.5 billion in combined pension contributions in 2010. But the state ended up contributing more than $4.1 billion in 2010, or $634 million higher than the systems predicted.

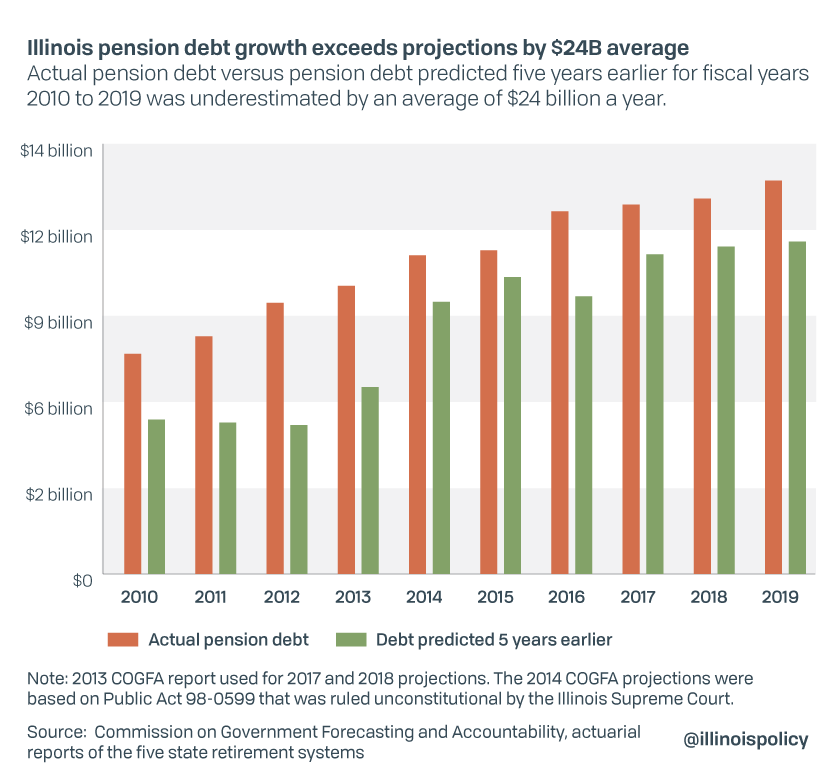

This pattern repeated itself during the next nine years. During the 10-year period of 2010-2019, pension contributions to the five systems were $7.6 billion higher than what the systems predicted in their five-year forecasts for each plan – a 15.4% average annual difference.

Pension contributions during this period were based on the so-called “Edgar ramp,” a 50-year payment plan resulting from 1994 legislation signed into law by then-Gov. Jim Edgar, which artificially lowered pension payments for 15 years before gradually increasing them. Well-run pension plans would have used a 20- to 30-year payment schedule that actuaries recommend to achieve 100% funding rather than the Edgar ramp’s 90% target after 50 years.

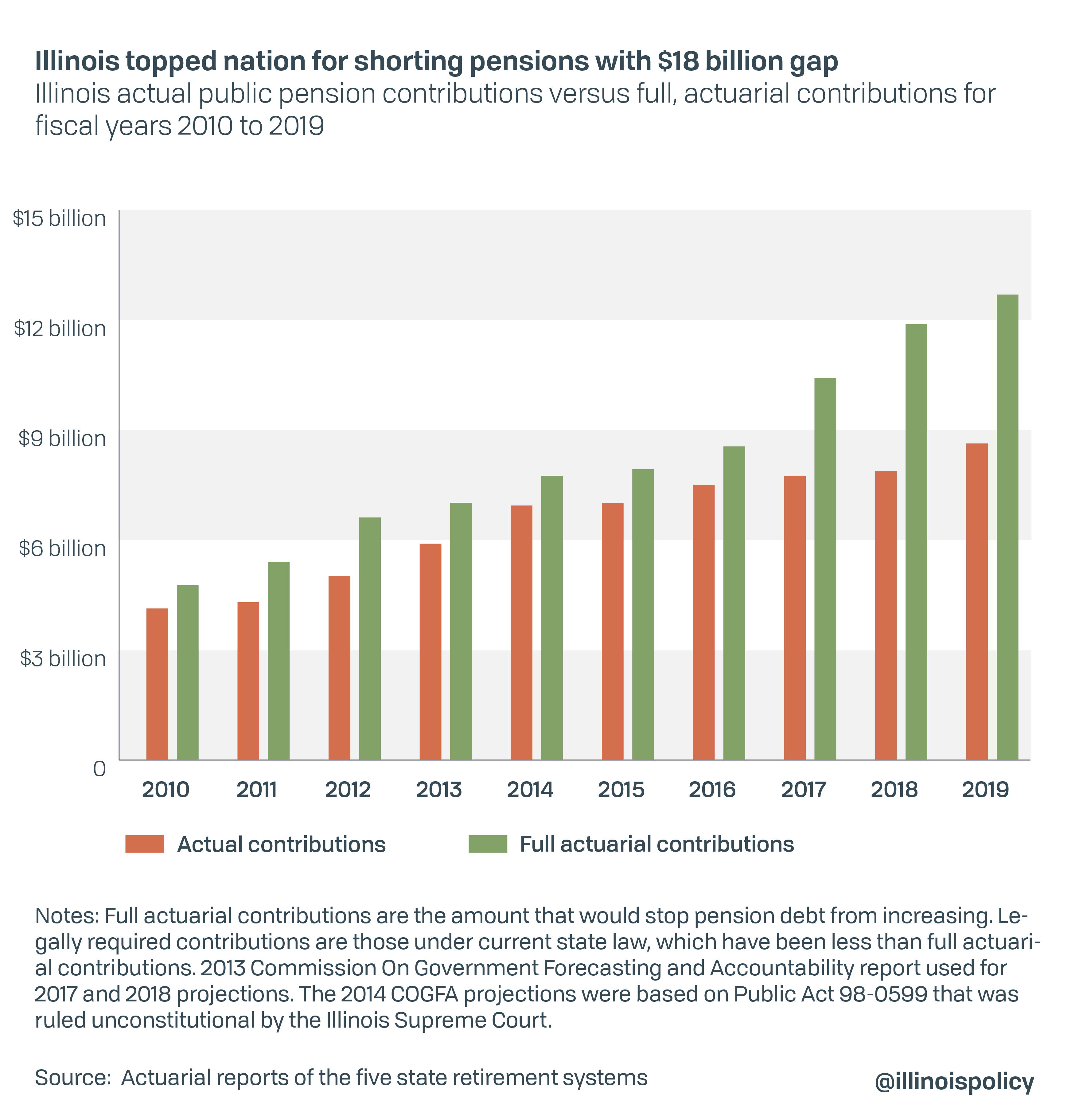

After the initial 15-year period, Illinois continued to make contributions below actuarial levels. In other words, even though Illinois was making contributions far higher than what the plans predicted was necessary, the state still wasn’t keeping up with what actuaries said was needed to keep the systems afloat.

From 2010-2019, Illinois contributed almost $18 billion less than what actuaries said was required to keep pension debt from growing. That contributed to the growth in pension debt that accelerated more quickly than the pension systems’ five-year projections.

It’s important to note that underfunding is not the cause of Illinois’ pension crisis, but a symptom of the fact that full payments are unaffordable.

Illinois state and local governments spend the most in the nation on pensions as a percentage of total revenues – about double the national average – and compared to the size of the state’s economy. Illinois’ pension debt is equal to about one-third of what the state’s economy produces in a year.

Pension debts in 2012 and 2013 were 82% and 54% higher, respectively, than projected five years earlier. Those projections were made in 2007 and 2008, before the financial crisis that caused pension investments to plummet in value. That should be a cautionary tale about future projections that don’t factor in an economic downturn, which is the case in Illinois.

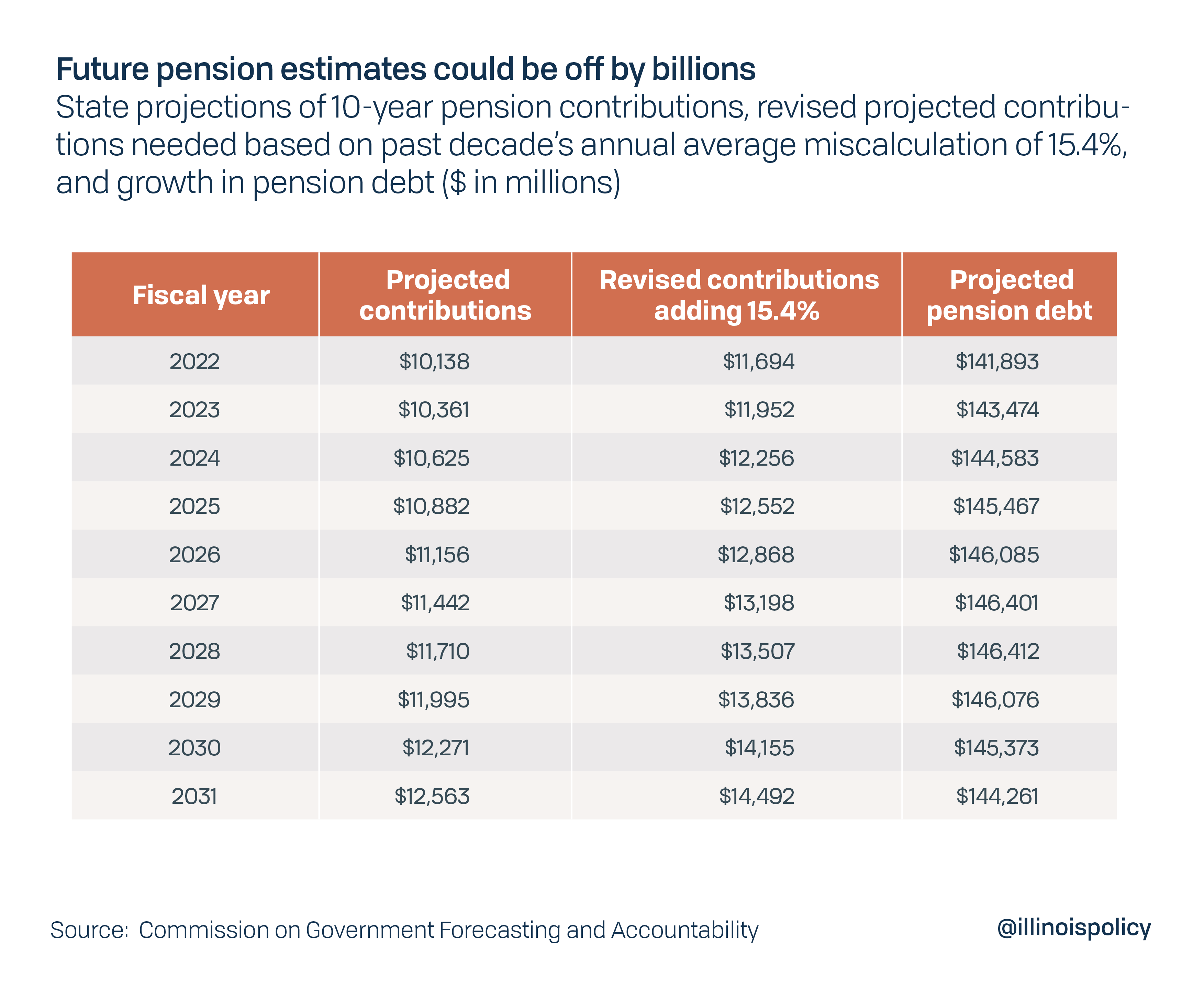

These projections are likely to be as inaccurate as they have been during the past 10 years.

The state continues to use overly optimistic rates of investment returns and does not take into account any downturn in financial markets.

While no one can predict the future, there will almost certainly be multiple recessions between now and 2045, when the state pension plans are scheduled to hit 90% funding targets.

A progressive income tax will not solve Illinois’ pension crisis

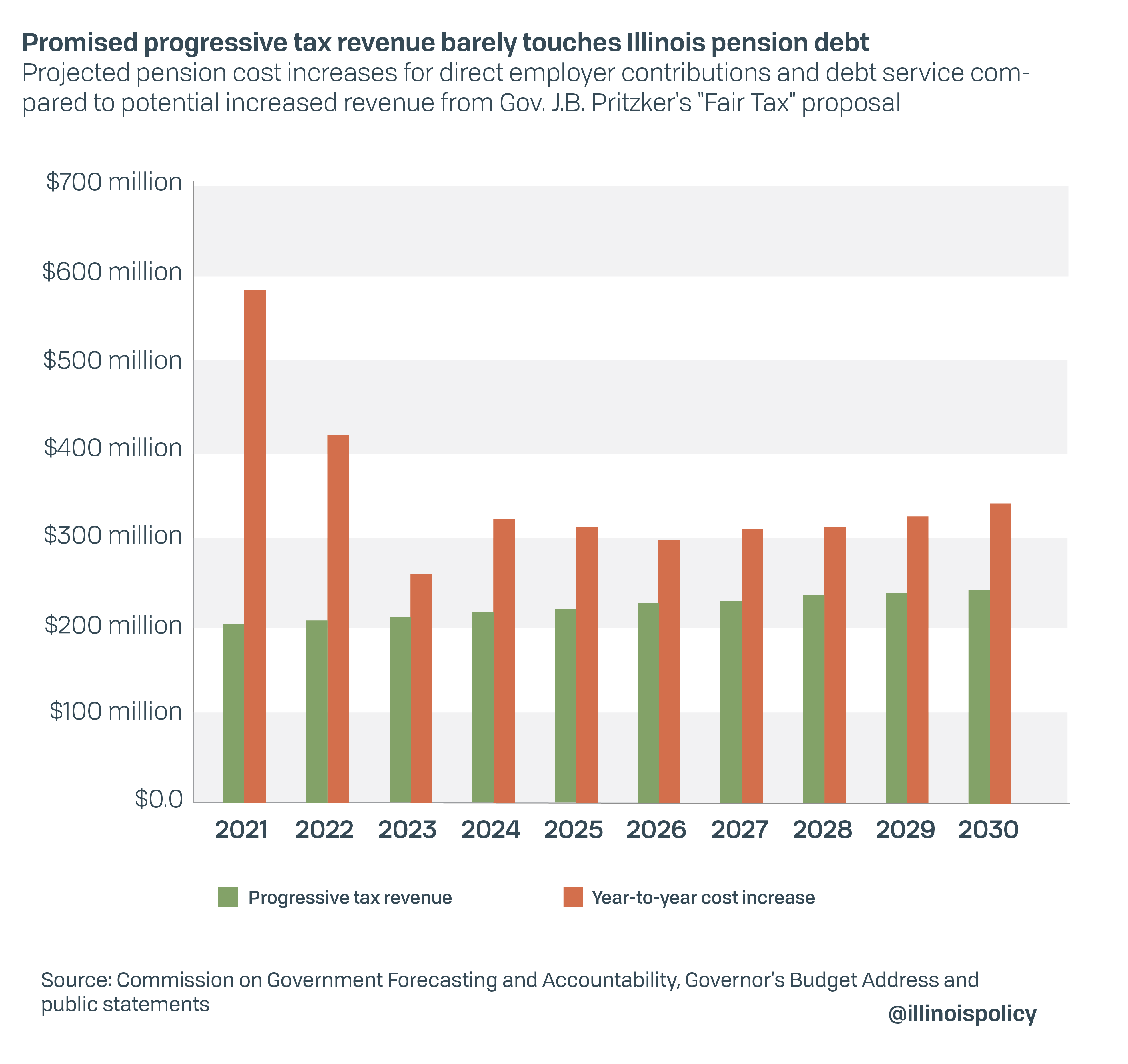

Gov. J.B. Pritzker refuses to support any pension reform, even an adjustment to the guaranteed 3% annual compounded increase in benefits, and has claimed that a proposed progressive income tax would, if passed, allow the state to pay down its pension debt.

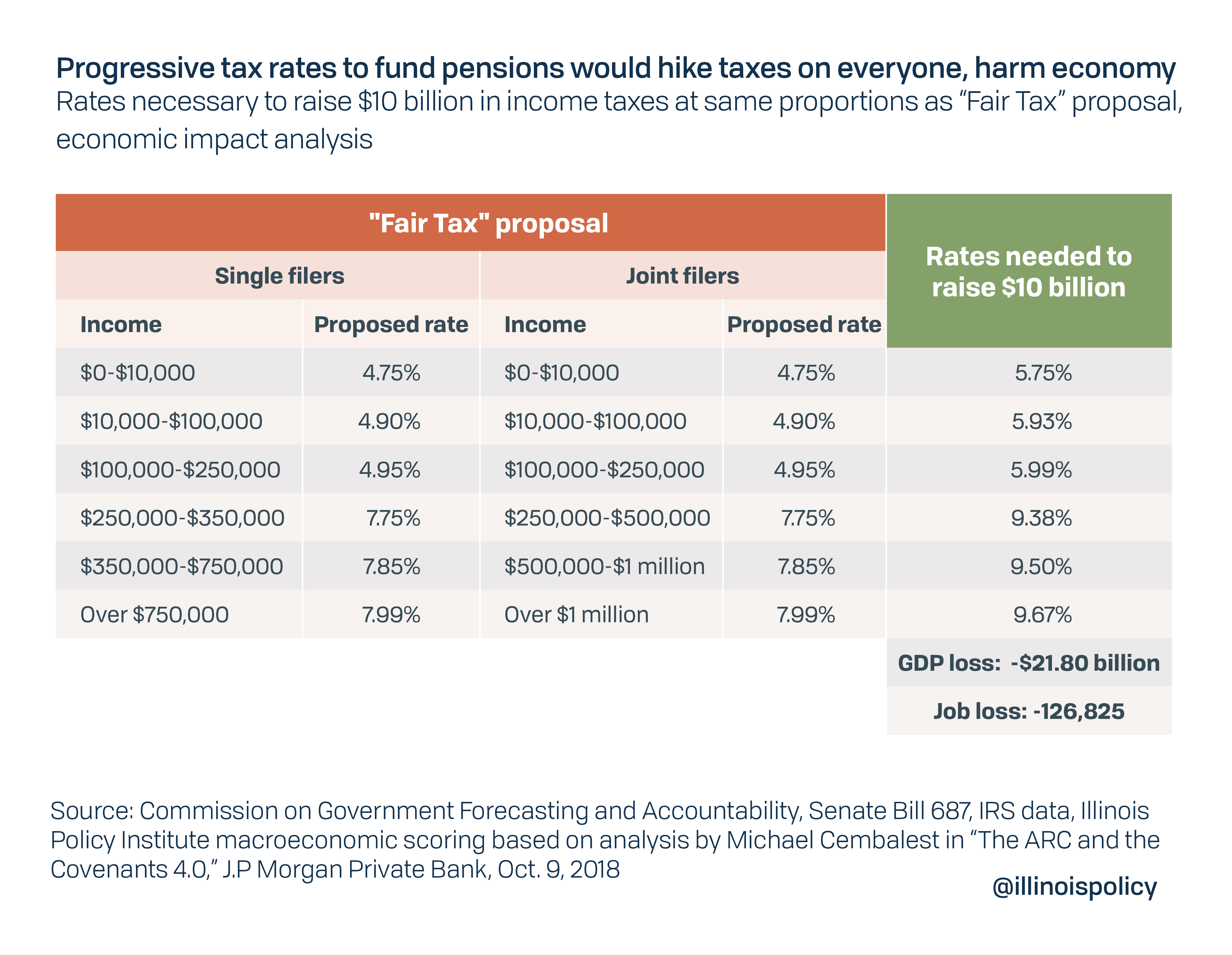

Illinois cannot solve the problem by raising taxes only on higher-income earners through a progressive tax. Pritzker has promised at least $10 billion in new spending even though his progressive tax will generate only $3.7 billion in new revenue. The math does not support the claim that a progressive tax will solve the pension crisis. In reality, only $200 million of the new revenue has been tagged for higher pension contributions.

A progressive tax that would actually raise enough revenue to pay off the state’s unfunded pension liability would need to significantly raise taxes on everyone, rather than just the top 3% as has been promised. A tax hike of the size necessary to solve the problem could cost Illinois’ economy nearly 127,000 jobs and $21.8 billion in lost gross domestic product.

Previous income tax increases were supposed to solve Illinois’ fiscal woes, but never did. A temporary tax increase in 1989 became permanent. Another temporary tax increase in 2011 that was supposed to partially sunset led to a record income tax hike in 2017, which also failed to alter the trajectory of pension debt. The crisis does not stem from a revenue problem.

Even strong investment returns have failed to solve the crisis. While the S&P 500 index tripled in value after July 2009, Illinois’ pension shortfall worsened by 75%, Wirepoints has noted.

Increased taxes, optimistic projections and strong investment returns will not fix Illinois’ pension debt crisis.

Until the state addresses the problem through constitutional pension reform that preserves earned benefits while curbing the growth in future liabilities, contributions to its five pension systems will continue to burden Illinois taxpayers and crowd out spending for core government services on which Illinoisans depend.