Illinois drowning in debt: $127 billion and counting

Illinois is often used as the poster child for how not to run a state. Money-hungry politicians perpetuate the state’s spending problem with higher taxes and more borrowing. Meanwhile, the state’s tax base continues to erode as tapped-out families and businesses move to states with more opportunities and friendlier business environments. Illinois’ debt has grown...

Illinois is often used as the poster child for how not to run a state.

Money-hungry politicians perpetuate the state’s spending problem with higher taxes and more borrowing. Meanwhile, the state’s tax base continues to erode as tapped-out families and businesses move to states with more opportunities and friendlier business environments.

Illinois’ debt has grown so quickly in recent years that the state now has some of the highest debt levels in the nation.

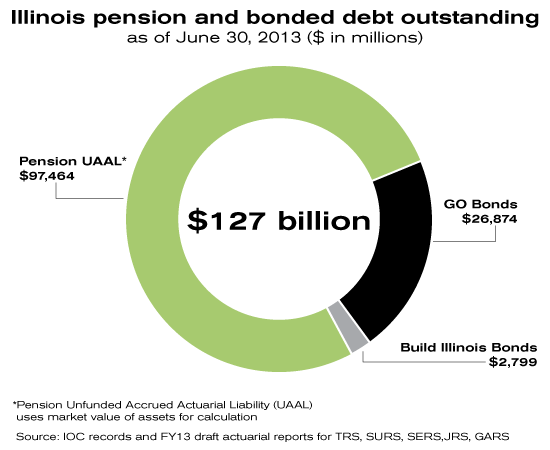

Illinois’ pension and other bonded debt exceeded $127 billion at the end of fiscal year 2013.

Pensions are the single largest driver of that debt burden. Illinois closed the last fiscal year with $97.5 billion in unfunded pension liabilities. And pension bonds made up more than $14 billion of the state’s nearly $27 billion in general obligation bonded debt.

To put those numbers into perspective, Illinois had just $7.6 billion in general obligations bonds at the close of fiscal year 2002 and its unfunded pension liability hovered around $35 billion. But rapid growth in unfunded liabilities and three very large rounds of pension borrowing caused those numbers to skyrocket.

According a recent report by the Illinois comptroller:

Since June 2003, Illinois has issued three series of pension bonds. The largest, which was worth $10 billion in June 2003, was followed by issues of $3.5 billion in January 2010 and $3.7 billion in March 2011. Each issue produced enough revenue to allow the state to make its employer’s contribution for the respective year instead of using General Funds revenues …

Pension bond debt service is a significant burden on the current budget. Debt service on the three previously mentioned pension bond issues will exceed $1.6 billion in fiscal year 2014.

Borrowing at this pace means more money is spent on interest payments instead of core government services. Until the state stops borrowing to pay for pensions and starts passing meaningful pension reform, Illinois’ budget will continue to suffer and taxpayers will continue to leave.